Launching Your First Stock Trading App Development Project

Content Map

More chaptersWith today’s Internet landscape, everything can be done online. Everything lies at the tip of your fingers, be it work-related tasks like sending emails or attending Zoom meetings, entertainment like watching a movie or playing online games, or even stock trading.

Recent research indicates that the number of annual stock trading app users will reach 137.1 million in 2022, which is a staggering increase from the 28.9 million users recorded in 2017. This significant rise in the number of users is not surprising, given the traditional stock trading process that was much longer and complicated compared to online trading’s simplicity and convenience.

The market for stock trading apps has grown exponentially and is expected to reach around US $16266.1 million in 2023, with an impressive compound annual growth rate of 21.1%. This figure highlights the potential for growth and profitability in the field of online stock trading. The number has more than doubled from just around 12,000 fintech startups in 2019 to over 26,000 fintech startups globally, according to BCG, indicating the high demand for online stock trading platforms.

If you have had the idea of building a stock trading platform for a while but have yet to seriously consider it, this is your sign to get started. This article will provide you with everything that you need to know to stand out in the stock market app competition.

What Do You Already Know about Trading Apps?

Before we dive straight into the topic of stock market app development, let’s quickly test what you already know regarding trading apps. Here is a quick and fun quiz to put your knowledge to the test.

1. What is trading software used for?

A. To execute trades in financial markets

B. To manage personal finances

C. To create virtual reality simulations

The answer is A. Trading software is used to assist with virtual trading.

2. What are some examples of fees that can be charged on a trading platform?

A. Withdrawal fees, management fees, and inactivity fees

B. Platform access fees, premium subscription fees, and trading fees

C. In-app purchase fees, advertisement fees, and borrowing fees

The answer is A. Different trading platforms charge for different kinds of specific transactions.

3. What are ways to monetize the training platform?

A. Marketing campaigns that promote the application

B. Selling the trading app

C. Payment for Order Flow (PFOF), transaction fees, subscription fees, in-app advertisement

The answer is C. Robinhood, a popular stock trading application that uses the PFOF model to generate revenue.

4. What is one way in which platforms can monetize the app using the Freemium model?

A. By implementing in-app advertisements for revenue generation

B. By offering users two versions of the application - a free one with basic features and a paid one with advanced features for premium subscribers

C. By charging withdrawal fees on the platform

The answer is B. Freemium models are popular ways to monetize your stock trading apps.

5. What are the benefits of building trading software?

A. Real-time data, built-in risk management tools, and in-depth technical analysis access

B. Long and complex development process

C. Faster trading process

The answer is A. In addition to acting as a platform for one to trade stocks, trading apps often provide users with dashboards, push notifications, and news so users can make quick and informed decisions.

6. What are the potential challenges in trading software development?

A. Automated trading, so there is little control over what is happening

B. Testing and simulation capabilities

C. Long and complex development process, data security, and regulatory compliance

The answer is C. As one of the sectors with the strictest regulations and the most sensitive data, the development process can be lengthy to ensure it is up to standard.

You should check out our detailed article on custom trading software development to read more on trading platforms in general: What they are, how to monetize them, and more.

A Quick Overview of Stock Trading Apps

Investopedia defines financial technology, or fintech, as the innovative technology designed to enhance and streamline the provision and utilization of financial services. Fintech is used to assist organizations, entrepreneurs, and customers in managing their financial operations, procedures, and lives more effectively.

Belonging to the fintech sphere, this is also how stock trading apps work. Share trading apps are end-user platforms that aim to help users automate and improve the delivery of financial services. Typically, the app acts as a middleman, connecting investors with brokerage firms, which then find a counterpart to play the opposite side of the trade.

With the use of technology, not only do users have access to the stock trading market at the tip of their fingers, but they can also handle their finances with ease. There are several variants one can choose from when you build a stock trading app.

Types of Stock Trading Apps

Trading Software by Platform

Always know your target audience. When you create a stock trading app, think about your audience’s preferences. Does your audience enjoy mobile or web platforms? Do they prefer Google Assistant or Amazon’s Alexa?

This is not to say that you need to cover every platform possible - but to slow down and seriously take the user’s preference into perspective.

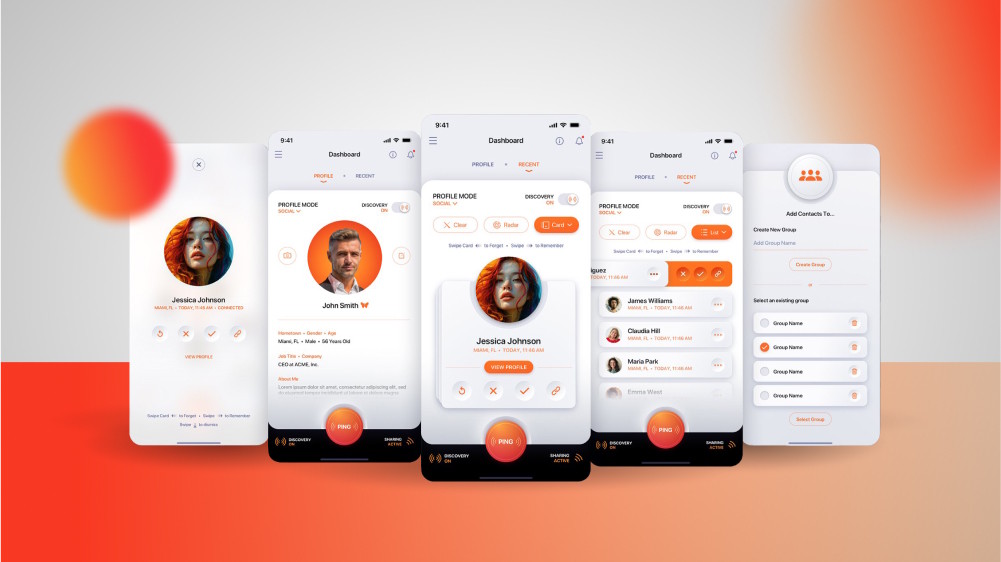

Mobile Investment Applications

Mobile trading apps are a great choice due to their convenience and accessibility. Individual investors are often the target audience for this kind of stock trading app. Core features like real-time market data, push notifications, and a customizable dashboard with the latest news are a must if you want to catch the attention of day traders and investors.

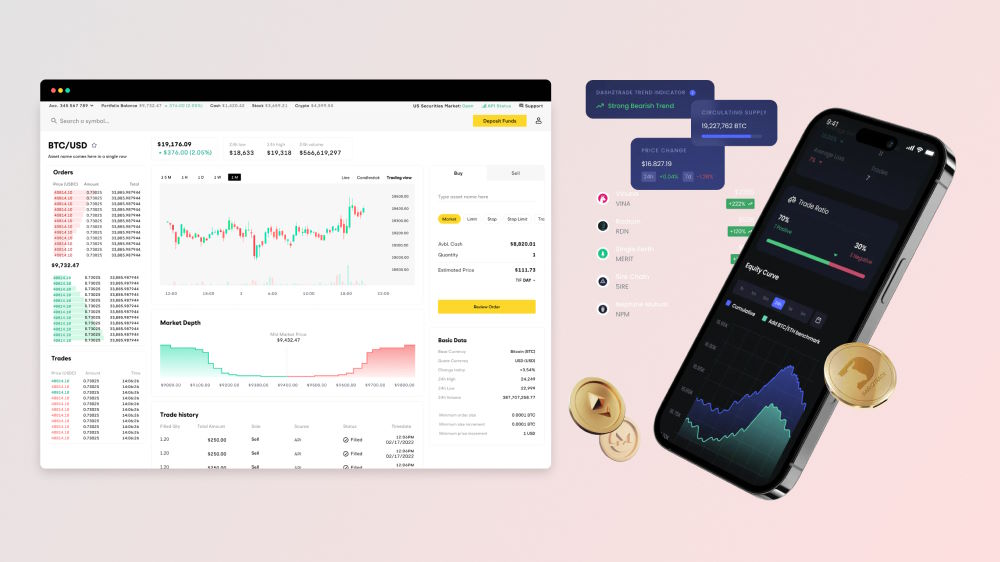

Web Platforms for Pro Traders

When it comes to the large volume professional traders need to handle daily, a web platform would be the best choice. As long as there is a stable Internet connection, traders have access to complex charting tools, real-time news streams, and the latest technical analysis tools.

Three Leading Trading Apps in the Market

In order to build a successful stock trading app, one needs to learn from the leading players in the market. Let’s take a quick look at them.

TD Ameritrade

- TD Ameritrade is an online brokerage best for active traders.

- It offers a large range of investment options, including stocks, bonds, ETFs, mutual funds, futures, bitcoin futures, and more.

- Low to no fees and no minimum balance requirements make it a good choice for traders who want to minimize fees on mutual funds.

- Provides copious trading platforms and tools, investment research materials, and educational courses and webcasts

- However, it does not offer fractional shares or cryptocurrencies and no longer offers its managed/automated accounts.

Robinhood

- Robinhood is an investment application that offers commission-free trading on several US-listed investment types, including high-yield cash management offerings, margin trading, and access to IPO investments.

- It also offers cryptocurrencies and a cash card that allows users to earn cash back at places where they shop, with the option to earn bonuses.

- Robinhood offers cash and margin accounts, as well as IRAs with a 1% match, but lacks joint accounts and education savings accounts.

- It is a good choice for beginners and crypto-focused investors, but it has a D rating with the Better Business Bureau and faced scrutiny from FINRA.

Charles Schwab

- Charles Schwab offers both convenience and low cost in one brokerage package.

- It charges zero trade commissions on most assets and has a network of over 350 physical branches in the US.

- Schwab brokerage accounts start at $0 and have low fees compared to other brokerages.

- There are high minimums for certain account levels and a limited selection of crypto assets.

- The company has received an A+ rating from the Better Business Bureau and has not been involved in any recent lawsuits or scandals.

- Pros include no minimum to open an account, automated account options, access to trading tools, and 24/7 customer service and research.

Tackle Security Issues in Stock Trading Apps Development

Cyber security should be at the forefront of every development project, and even more so since stock trading applications deal with a lot of sensitive user data. According to the State of Authentication in the Finance Industry 2022, 80% of the surveyed companies experienced a security breach due to weak authentication. When it came to system and service authentication and access for financial institutions, 63% of the compromised firms took no action to modify their security procedures.

We will guide you through the process of stock trading application development, largely focusing on how you can tackle potential security threats.

Discovery Phase

This is where all the planning gets done before the actual development phase. This is when you will

- Define the target audience and what problems the app will solve

- The main features of the application are market analysis, trading tools, a dashboard, etc.

- Find a team of experienced stock app development team.

Define the Scope

- Discuss with the development team to come up with a plausible timeline.

- You can hold workshops to better understand your customers and see if there are any inputs when it comes to trading stocks.

Secure Your App

Even though the financial services industry is one with strict rules and regulations, it is also a prime target for cyber attacks. Here are some measures you can take to protect your fintech app.

Two-Factor Authentication

Prevent unauthorized access by using two forms of identification. Give users and businesses the ability to add their Face ID, emails, phone numbers, and fingerprints to safeguard their data.

Data Encryption

Data encryption is a crucial security methodology that aims to protect sensitive information by converting it into a code only accessed by authorized individuals. With encryption algorithms like HTTPS, data can be securely transferred and stored, minimizing the risk of unauthorized access and data breaches.

Effective Security Practices

Cyber threats are ever-evolving, so make sure the security team is constantly updating the codebase to keep the app secure. Common security practices like SQL injection, XML external entities, cross-site scripting, etc., should also be implemented.

User Data Protection

- Always check to ensure compliance with data protection regulations like GDPR and CCPA.

- Document comprehensively the use of any sensitive data.

- Control the access to such data by setting up robust monitoring and logging to detect and respond to potential security concerns.

API Integration

For investment software development, you can look into APEX Clearing, Alpaca, Interactive Brokers, and DriveWealth APIs

These APIs offer features such as fractional trading, pre-market & after-hours trading, portfolio management, margin trading, advanced orders, etc.

All trading APIs provide real-time market data, secure multi-factor authentication, and support for business accounts.

Development

It is time to organize your development team; you can either recruit an in-house team or outsource a credible one like Orient Software.

During the development phase, you need to choose the right tech stack. Choosing the right tech stack is what creates a winning app. Again, if you are building a custom stock trading app, it is best to consult experts on the matter.

Testing, Delivery, and Maintenance

- Before the launch, carefully test the app’s features across different devices and minimize bugs and glitches.

- After all the Testing is done, it is time to launch the app. You can run campaigns to introduce it on social media.

- Based on the feedback, conduct regular maintenance and updates for the application.