Bank Smarter, Not Harder: The Best Mobile Banking App Features

Content Map

More chaptersIn today’s interconnected world, mobile phones are our constant companions. From communication to entertainment, almost everything can be done via the shiny rectangular screen, even banking. With only a few taps, mobile banking apps can handle all of your basic financial needs.

But what truly sets a mobile banking app apart? With the rise of online banking, businesses need to keep two key strategies in mind: A customer-centric approach and providing the best mobile app features. This article will discuss both these aspects and how you can stay on top of the competition. Let’s dive right in!

Key Takeaways:

- Even after the pandemic, mobile banking apps are here to stay due to their convenience and the widespread use of mobile phones.

- What sets a successful mobile banking app apart is how its features elevate the overall customer’s financial service experience.

- While there are key features that every banking app should have, developers can be creative and add more details to meet customer’s ever-evolving needs.

Mobile Banking App Statistics: An Overview

- Statista projected that by 2024, there will be nearly a billion online banking users worldwide. Its number of users has also been increasing steadily over the years.

- A report by Worldmetric.org stated that 53% of users find that mobile banking helps them become more conscious of their financial condition. More than 70% of mobile bank customers think that remote deposit capture—which involves depositing checks through an app—is beneficial.

- Research and Markets report noted that 79% of banking app users want to see recent transactions, and 90% of customers want to check their account balance when using mobile banking apps.

With these statistics, it is clear that the use of mobile banking apps is not only widespread but preferred for its convenience and accessibility. Users’ growing satisfaction and dependence are creating a shift in the financial industry. It is more than a trend - online banking services are here to stay. To stay ahead of the curve in the very crowded market of mobile apps, it is crucial to emphasize and prioritize customer experience.

Why Customer Experience Is the Key to Sucess

Customer satisfaction is a powerful factor that sets businesses apart. This statement rings true, especially in the financial world.

Financial procedures are typically complex and involve multiple steps. While simplifying the process takes lots of time and effort, what companies can do is ensure a seamless customer experience. Whether it is banking transactions, withdrawing cash, or applying for a loan, the process should be intuitive and easy to follow. A Signicat survey reports that the proportion of European customers who stopped using a digital banking app increased from 38% in 2019 to 63% in 2020. That is to say, about two-thirds of prospective customers discontinued their interest even before they had the opportunity to use the service. One significant reason behind this abandonment is that the online application took too long to complete.

To ensure that customer satisfaction is taken into proper account, businesses need to be aware of the customer’s journey, right from before the onboarding decision is made. By carefully analyzing each touch point customers make with the mobile app, companies stand a higher chance to attain new customers, foster loyalty, influence recommendations, and ultimately increase profits.

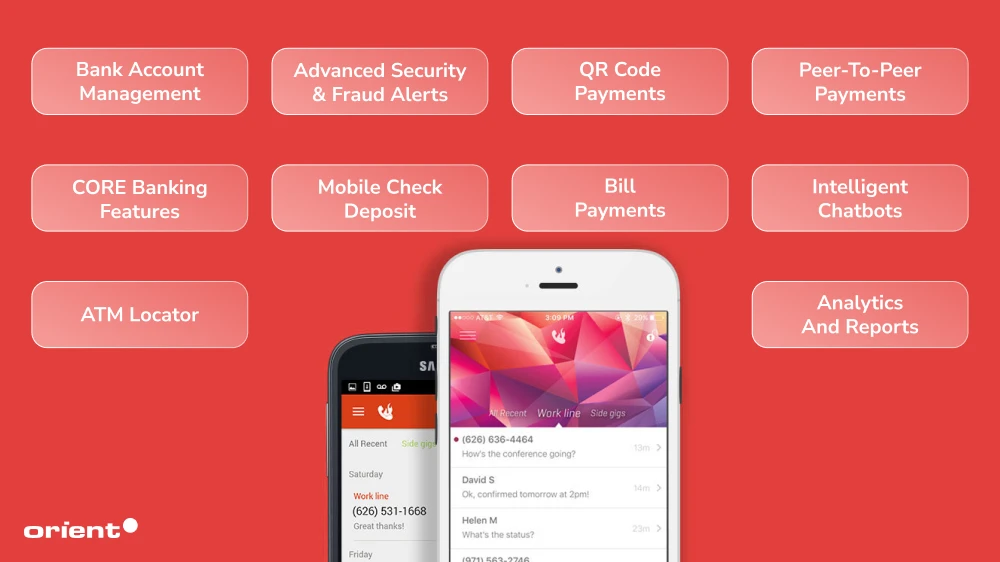

Mobile Banking App Features for User Experience Success

A shifting mindset is the first step toward success in mobile banking. The next step teams need to take is to invest in the right mobile banking features to foster and maintain customer satisfaction.

Bank Account Management

Many choose to use mobile banking apps as they raise their awareness regarding their financial situation. In some cases, mobile banking apps even change the way some users manage their finances. Bank account management can be broken down into smaller features, including:

- Monitor account activity and view transaction history

- Track savings and set saving goals

- Transfer funds

- Track and plan investments

And the list goes on. While there are essential features that every app should have, teams have the freedom to design and add creativity to the mobile app.

Advanced Security & Fraud Alerts

One of the biggest concerns of users with mobile apps is security. Mobile banking apps contain numerous sensitive information, so businesses have to implement proper security measures to safeguard customer’s data. Multiple security measures can be taken to safeguard mobile banking apps, including:

- Two-factor authentication (2FA): 2FA is a security measure that ensures online account access is authenticated. Users enter their username and password, followed by a second factor, which could be a personal identification number, password, secret questions, or a keystroke pattern.

- Integrating AI and ML to alert users about the transactions that might need more attention.

- Touch ID and voice recognition

- Activity reports: the app regularly reports activity, login attempts, transactions, etc.

QR Code Payments

Most mobile devices likely already have a built-in QR code scanner. QR codes offer an additional payment method for users. They are preferred for allowing fast and convenient contactless payment. In the US, almost 80% of consumers believe using QR codes is safe. Businesses can easily gain user insight by tracking customer engagement.

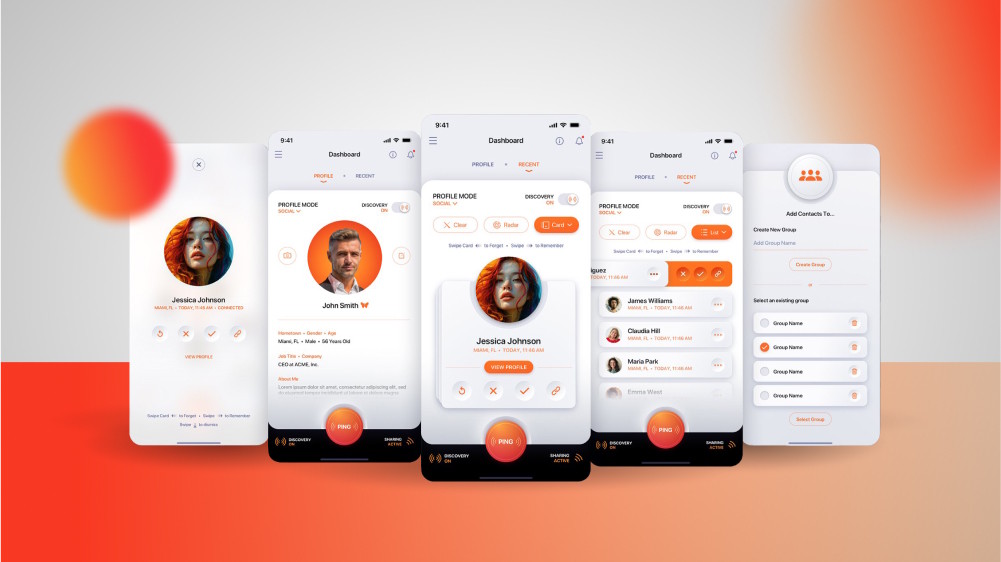

Peer-to-Peer Payments

Peer-to-peer payments, often called person-to-person payments, are a kind of mobile banking that involves digital payments between two people. Users can transfer money to one person’s bank account or app from their checking account, credit or debit card, or payment app.

This can easily be one of the most used features in mobile banking apps. As paper money is fast losing its popularity, peer-to-peer payment makes splitting bills during meals or borrowing money easy and fast.

Users often opt for P2P services provided by banks rather than third-party vendors as they often feel more secure and safe.

CORE Banking Features

CORE stands for Centralized Online Real-time Environment. CORE banking allows customers to manage their accounts and transactions from anywhere, at any time. It treats the bank as a single, unified entity, regardless of branch locations or national boundaries. CORE Banking is the backbone of modern banking, streamlining services like management, loans, and transactions, ensuring consistency and efficiency for customers no matter where they are. IT Core Banking offers attractive features like a centralized dashboard, loan management, interest calculator, etc. Not only does this system improve operational efficiency, but it also improves customer experience.

Mobile Check Deposit

This convenient feature allows you to deposit checks to your bank with the use of a mobile device. You can add the check to your account right from the comfort of your home without needing to visit the ATM or the bank drive-through window.

When adding this feature to your app, think about the types of checks users can add to the account, like personal checks, business checks, or cashier’s checks. Mobile check deposits may not be allowed for foreign checks or traveler’s checks.

If the check is deposited successfully, the app will send a notification to let you know that the check is being processed.

Bill Payments

In today’s fast-paced world, keeping up with multiple bills can feel overwhelming. Relying on traditional methods like checks can be risky as they may get lost in the mail. Paying bills in person often requires time and effort that busy schedules just can’t accommodate. With everything on your plate, it’s easy to forget a due date, leading to unnecessary stress or late fees.

This is why more people are turning to the convenience of online and automated bill payments through their bank’s mobile app. By scheduling payments in advance and setting up automatic recurring payments for regular expenses like utilities, rent, or credit cards, you can ensure everything is taken care of without even getting out of your house. With custom notifications, you won’t have to worry about missing payment again.

Intelligent Chatbots

AI is developing in leaps and bounds. AI has been integrated into various tools to elevate user experience, and intelligent chatbots are no exception. In mobile banking apps, chatbots can serve as round-the-clock digital assistants, answering frequently asked questions about bank accounts and savings accounts, resolving issues, and even initiating transactions. By providing instantaneous, personalized responses, chatbots reduce wait times, enhance customer satisfaction, and alleviate strain on human support staff. AI chatbots ensure customers’ needs are met whenever and wherever they are required.

ATM Locator

ATM locator is a handy feature. Instead of opening a search browser to type in “ATMs near me,” a simple tap on the mobile app will give users all the information they know. It is the attention to small details that allows certain banking apps to stand out from others.

You can always get creative and add more details to this feature, like informing users which ATMs are in a high-traffic area.

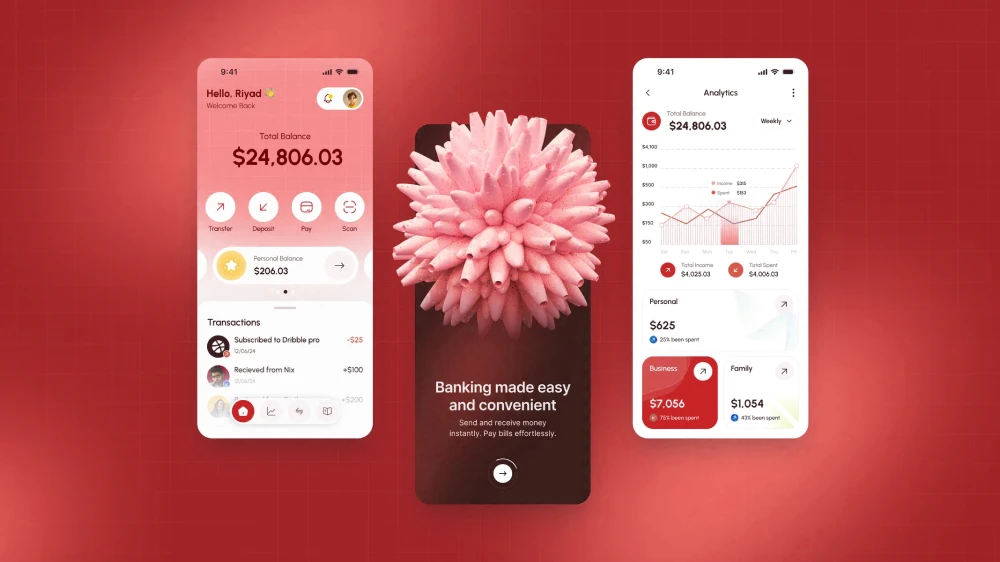

Analytics and Reports

This feature provides a dual benefit. On one hand, customers gain valuable insights into their spending habits and investment portfolios to make more confident and informed financial decisions. On the other hand, banks have a clearer understanding of customer behaviors and preferences, allowing them to make data-driven adjustments that improve services and meet evolving customer needs.

Building Mobile Banking Apps for Sucess

It is easy for financial institutions to focus solely on improving an app’s profitability. However, these organizations need to take a customer-centric approach to retain and constantly enhance customer’s experience. By consistently enhancing the customer experience, banks can build loyalty and satisfaction, which drives sustainable growth. Prioritizing the customer experience is a proven, stable path to improving the bottom line – every organization’s core objective.

With nearly two decades of experience, Orient Software specializes in meeting customer demands and elevating their experience. Reach out to us today to discover how we can help kickstart your project!

FAQs

Are mobile banking apps safe?

Mobile banking apps are quite safe. However, like any other online service, there are potential risks.

The app’s level of safety depends on how cautious and well-informed users are. For example, weak passwords or insecure public Wifi are prime targets for malicious actors who are looking to steal banking credentials. For banks, they can take strong measures like encryption or multi-factor authentication to protect user’s data.

Do mobile banking apps come with any costs?

Most mobile banking apps are free. Users won’t need to pay to view their bank balance, track their spending, or set automated recurring payments. However, there often is a small fee for services like fund transfer.