The financial sector is one of the first industries to embrace technology: from mainframe systems in the 1980s to algorithmic trading and high-frequency analytics today. With the increasing amount of financial information, automation, accuracy, and scalability demands have compelled institutions to consider a development alternative to spreadsheets and conventional databases: programming-based systems.

Programming has traditionally been a supporting tool, but it has changed in recent years to be a strategic benefit in the field of finance. A 2023 report by Deloitte also revealed that more than 65% of financial institutions also rely on programming and data analytics to aid risk management and investment strategies. In the meantime, Citigroup, JPMorgan Chase, and Goldman Sachs have incorporated coding, especially Python, into their analyst training programs, and they have found that it is a core competency of a modern finance worker.

Python in finance has emerged as a prominent language among the various languages used because of its availability, quick development, and strong data-processing features. It removes the financing-technology gap, enabling those involved to handle massive financial data, automate reporting, and even roll out AI-driven models, all in one integrated ecosystem.

Why Python Is a Good Match for the Finance Industry?

Python is one of the most popular programming languages in all industries, and in no other sector is its impact more visible than in the financial industry. This language is characterized by simplicity, readability, and versatility that allow both the technical and non-technical workers to automate processes, analyze data, and create scalable solutions without the high learning curve that is associated with traditional programming languages.

Its equilibrium is one that few languages can rival in the financial world, where it is important that speed, precision, and adaptability are desired. The tool enables a finance professional to create easy-to-understand, functional code in just a few lines, unlike the Java or C++ languages, which feature complicated syntax and require a lengthy development cycle. This ease of use implies that analysts and business teams do not have to sit back and wait for the developers to do everything, but they can actively be involved in automating financial data analysis, building reports, or building real-world applications that meet their personal needs.

However, the real difference with this technology is its flexibility. It can flawlessly combine databases (SQL and NoSQL), spreadsheets such as Excel, APIs, or large data systems. With thousands of libraries available in its open-source ecosystem, it can be used to analyze and visualize data and do machine learning and web development, and it is more than a language: it is a platform to innovate.

Consequently, Python in finance is no longer regarded as a means of automating the reports in a straightforward fashion. It has become a strategic asset that closes the divide between technology and financing, enabling organizations to change more quickly, make smarter decisions, and be ahead in a data-driven world.

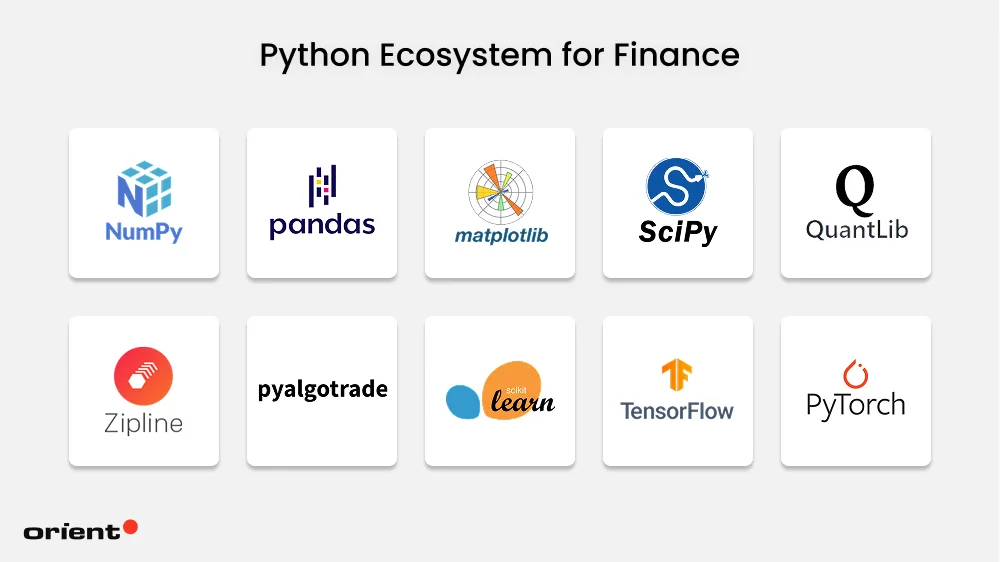

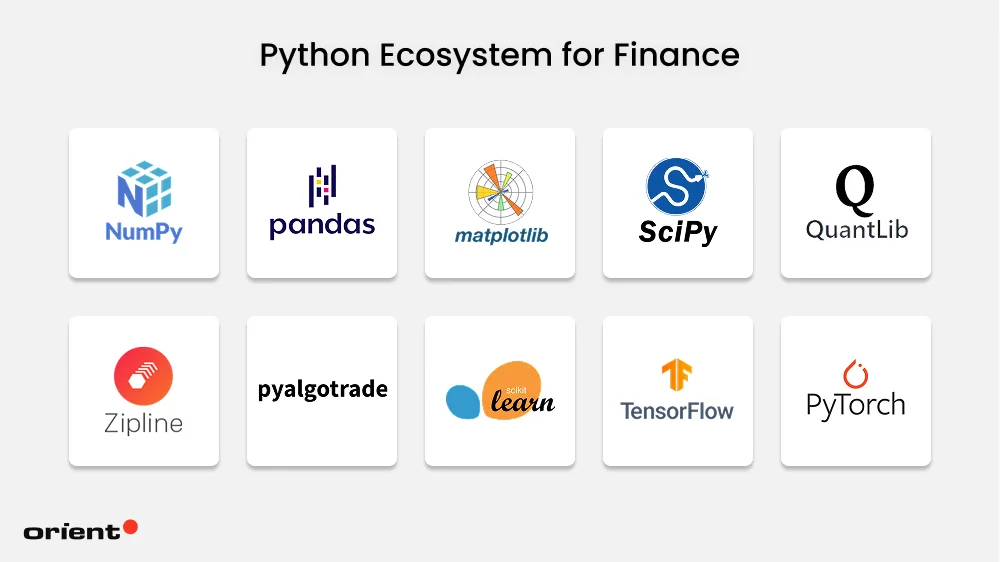

Python Ecosystem for Finance

One reason Python is so powerful in finance is that it has a strong and broad ecosystem - one of the most active in the world of programming languages. Python programming has developed a full ecosystem based on simplicity and flexibility to allow financial professionals, data scientists, and financial analysts to work with large amounts of financial data, automate, and create intelligent data analysis tools to support informed decision-making in the finance sector.

The Foundational Libraries: NumPy, Pandas, and Matplotlib

NumPy gives the fundamental data structure of scientific computing: the high-performance n-dimensional array (ndarray). In finance, it is important to effectively manage large matrices of asset returns, volatilities, and other numerical data to support the execution of vectorized operations that can run at near C-language speed, an important requirement in accelerating portfolio calculations and Monte Carlo experiments.

Pandas is the definitive library allowing users to manipulate and combine files or data types with ease. It brings in the DataFrame and Series objects, which are specifically created to work with labeled, tabular, and time-series data and are therefore highly appropriate to financial data such as historical stock prices, fundamental reports, and transaction logs. Pandas makes simple what would otherwise be tedious, time-intensive activities, such as cleaning up data, combining disparate data sets, addressing missing values, and computing a rolling-window (moving averages) analysis, which are foundations of technical analysis.

Matplotlib provides the capability to visualize financial data and create interactive visualizations of financial markets and stock prices. It enables the finance professionals to design a very diverse collection of static, animated, and interactive plots. The interpretation of complex financial trends can be made easy and open to all with simple line charts of stock prices over time, to more complex histograms of return distributions, and scatter plots to analyze the correlation.

Quantitative and Advanced Libraries

Beyond the fundamental tools, there are dedicated libraries with more advanced needs of the quantitative finance and risk management community. SciPy extends NumPy with optimization, linear algebra, interpolation, and statistics modules, whose functions are critical in such applications as portfolio optimization (efficient frontier) and distributional modeling of market data.

When the tasks are deep and domain-specific, such libraries as QuantLib are remarkable. This is an open-source, broad-based quantitative finance library that offers the model, trade, and risk management of more complex financial instruments, the most notable of which are the derivative price and the interest rate model. To back-test and write an algorithmic trading strategy, the back-testing engines of Zipline and PyAlgoTrade offer event-driven engines that enable quants to back-test and test strategies on past and present data in a realistic market environment, and enable rigorous testing and performance analysis before going live. Machine Learning (ML) has been applied to finance effectively by libraries like Scikit-learn and TensorFlow/PyTorch and is being used to score credit risks and detect fraud, as well as for more sophisticated predictive analytics of market behavior.

Python in Finance: The Power of Versatility

Python is useful in the financial sector because it offers flexibility to fulfill the need for high-level data interpretation and low-level system development. The language can perform at key levels, from detailed data analysis to the creation of complex algorithmic trading systems.

Data Analysis, Modeling, and Visualization

Python is the backbone of the current financial data analysis and visualization, mostly through its fundamental libraries, Pandas and Matplotlib. Pandas DataFrames are used by finance professionals to efficiently load, clean, transform, and analyze large and complicated time-series datasets, including historical stock prices, currency exchange rates, and economic indicators. The latter is important in financial modeling, which involves analysts creating and testing hypotheses, such as by computing rolling betas, using the capital asset pricing model (CAPM) analysis, or modeling the behavior of a portfolio in different stressful situations (Monte Carlo simulations).

Python can also facilitate robust prediction using libraries such as statsmodels or Prophet, where autoregressive models (ARIMA) can be created to forecast asset values or macroeconomic data. These complicated numerical results are then converted into easily understandable charts in Matplotlib and Seaborn, line charts to identify trends, and scatter and box plots to examine relationships, and allow data-driven decision-making to be taken by investment committees and stakeholders.

Algorithmic Trading and Quantitative Strategy

Python may be the most influential tool in algorithmic trading and quantitative strategy. Python offers an easy-to-learn and high-performance development system that quants use to design, back-test, and deploy high-frequency trading (HFT) and low-latency strategies. The syntax of the language, together with its robust libraries such as Zipline or PyAlgoTrade, enables developers to specify sophisticated trading logic, e.g., a mean-reversion strategy or momentum strategy, and run it against historical data. Importantly, Python manages the whole process of algorithms:

- Data Ingestion: Retrieving real-time market data using APIs (e.g., yfinance or broker APIs).

- Signal Generation: Computing technical indicators (using libraries such as TA-Lib) to give buy/sell signals.

- Risk Management: The introduction of constraint and position sizing regulations.

- Execution: Directly interfere with broker platforms to automatically trade.

The Python ecosystem, including performance-enhancing libraries such as NumPy and Numba that can compile and execute quickly and provide fast array operations and just-in-time compilation, can be used to ensure that the underlying mathematics can be run as fast as possible and can be scaled to provide a competitive advantage.

Python in Finance: The Power of Risk Management and Compliance

The power of Python in finance is further applied in risk management and regulatory compliance, where its performance in terms of computational speed and extensive statistical libraries is applied to uncertainty management and compliance with progressively stricter regulations in the global arena.

Risk Assessment Tools and Modeling

Python is the language of choice when creating effective risk assessment models to quantify and predict financial exposure. The essence of this paper is based on the computation of measures such as Value at Risk (VaR) and Conditional Value at Risk (CVaR) that estimate the possible loss a portfolio may experience at a given confidence level. Python is used in all three major types of VaR calculations by professionals:

- Historical Simulation: Processing time-series data with Pandas and empirical quantiles with NumPy.

- Parametric VaR: The use of the statistical functionality of SciPy to model the data of returns (by fitting to a normal or other distribution, e.g., GARCH models through the Arch library).

- Monte Carlo Simulation: Using Python random number generation and high-performance computing to simulate thousands of future market scenarios, a global picture of tail risk and extreme losses will be presented.

Python is also capable of highly detailed stress testing and scenario analysis, which allows risk teams to simulate the effects of a catastrophic and low-hazard event (such as a major market crash or a sovereign default) on a full portfolio. The scikit-learn library is also essential to develop machine learning (ML) models to score credit risks (predict default) and detect fraud to make risk evaluation processes more proactive instead of reactive.

Compliance Automation and Reporting

The compliance with the regulations is a manual and resource-intensive task, which is considerably simplified with the help of Python automation. The language is also used to develop strong frameworks that guarantee data integrity and produce auditable reports that meet the requirements of Basel III, Solvency II, and MiFID II. The entire data pipeline is automated with Python scripts, relying on such libraries as Pandas:

- Data Extraction and Data Validation: The connections to multiple data sources (databases, APIs, spreadsheets) to obtain transaction logs, customer information (Know Your Customer—KYC), and other information.

- Compliance Checks: Automation of rule-based algorithms to identify transactions or accounts that go against established regulatory limits (e.g., suspicious volume, breach of sanctions list, or too much risk exposure based on the risk profile of a particular client).

- Regulatory Reporting: Converting and consolidating clean data into the formats (e.g., XML, CSV, or formatted Excel reports) needed by regulators. The capability of Python to integrate with the internal reporting tools and to produce unambiguous and version-controlled documentation offers an audit trail, which is needed when it comes to regulatory review. This automation significantly reduces the risk of human error and liberates compliance officers from concentrating on complex and interpretative issues, instead of spending time on data preparation.

Python in Finance: The Power of Enhancing Financial Applications

Python is a critical innovation engine in finance, as it is used not just as an analysis tool but also as the main language on which to build advanced, production-quality financial applications. The fact that it can be smoothly implemented with the latest technologies and its ability to create a new custom in a relatively short period are some of the motivating factors in this sphere.

Integration with Other Technologies

The power of Python in finance is enhanced by the fact that it is closely embedded in the Machine Learning (ML) and Artificial Intelligence (AI) ecosystem. This assimilation plays a significant role in the creation of the next-generation financial services. Python libraries such as Scikit-learn and deep learning models such as TensorFlow and PyTorch are employed by data scientists to train models to be used in life-and-death applications:

- Algorithmic Strategy Enhancement: ML models are used to study the complex market trends, news sentiments (through Natural Language Processing-NLP), and real-time data to produce predictive information that enhances strategic performance and the strength of algorithmic trading strategies.

- Risk and Fraud Detection: AI algorithms are constantly applied to large volumes of transaction data to identify anomalies and indicate potentially fraudulent transactions in a significantly faster and more accurate way than traditional rule-based algorithms.

- Personalized Finance: Python-based AI/ML models work off customer spending behavior and risk profile, financial objectives, and analyses to give individual investment advice, credit applications, and robo-advisory advice.

- Document Analysis: Python-based NLP tools can be used to automate the process of extracting important information in unstructured financial documents, e.g., legal contracts, earnings releases, and news articles, as well as hasten research and due diligence.

The interoperability between data manipulation in Pandas and model training in Scikit-learn is why Python is the language of choice among quantitative groups who wish to create data-driven decision support systems.

Development of Custom Financial Applications

Financial companies that need to create their own proprietary software are drawn to Python to develop applications that are specific to their company, as opposed to using off-the-shelf software. Its non-complex syntax, rapidity in development, and vast community-based support enable in-house engineering departments to concentrate on financial logic instead of boilerplate code. Several custom tools are created using Python:

- Custom Trading Terminals: Developing bespoke front-ends for traders based on frameworks such as Django or Flask for the back-end and specific custom libraries to provide real-time data feeds.

- Proprietary Back-testing Platforms: Developing special systems (usually more granular than those in the market) to strictly test new trading and portfolio strategies using proprietary and carefully curated firm data.

- Internal Data Dashboards: Develop real-time, interactive data visualization applications based on software platforms like Plotly and Dash to track risk exposures, liquidity, and strategy performance for top management.

Quantitative research, risk analytics, and trade execution, Python is actively used by major financial institutions and hedge funds such as J.P. Morgan Chase and Goldman Sachs to develop and operate their internal systems. As an example, J.P. Morgan Chase was using Python to build a massive risk management and portfolio analytics system, which would give their traders and quants a highly flexible environment to apply complex financial models and to have a competitive advantage by having in-house technological resources.

Insights from Finance Professionals

Finance practitioners of all levels of the industry, from quantitative analysts to financial planners, have admitted to the undeniable usefulness of Python as a tool, but there are certain challenges in finding ways to integrate it into their established workflows, and they need a strategic manner of utilizing the benefits of the tool.

Common Themes and Challenges in Integration

The wide range of Python can be considered a significant strength, but finance departments often face challenges when it comes to adapting to the current enterprise architecture. Performance and scalability are frequent challenges with high-frequency trading systems, where interpreted code like Python is occasionally slower than compiled code such as C++. In cases requiring intense computation, such as the use of libraries that have C backends (such as NumPy) or offloading code to more performant languages, professionals may be required to do so, making it complex.

The other important problem is integration with legacy systems. A large number of financial institutions use proprietary software and database systems (typically based on Excel or VBA) that are many decades old. It can be a tremendous task to connect modern Python applications to these dissimilar and occasionally ill-documented legacy systems, and requires large-scale development of custom middleware.

Lastly, there is the talent and culture gap. Although the Python skills market is soaring, it has been difficult to locate finance professionals who are also skilled coders or to include data scientists in the traditional finance teams. This deskilling potential creates low-quality controls and technical debt in the homegrown Python solutions.

Success Stories and Innovative Applications

Nevertheless, the list of successful Python applications in finance is lengthy and transformative, especially in the field where intricate computation and automation are needed. Financial Modeling and Risk Management Python has been used by firms to implement advanced, open models of VaR and stress testing and Monte Carlo simulations as an alternative to opaque, faulty spreadsheets.

The best success can be seen in algorithmic trading, where Python has been made into a de facto language. Back-testing and optimizing portfolios are used by quant funds and investment banks using libraries such as Zipline and Back-trader. Companies such as Kate Kurth have created proprietary, large-scale, Python-based analytics and trading systems (including Athena), which allow online risk computation and the implementation of new trading models by machine learning.

Machine learning models that run on Python have been used in the FinTech industry to develop new applications, such as in FinTech, improved credit scoring, real-time and adaptive fraud detection, which are highly effective at minimizing financial losses and promoting efficiency.

Tips and Strategies for Effective Leverage

The finance experts suggest the following measures to successfully use Python in the data analysis, visualization, and decision-making process:

- Master the Core Data Stack: The basis of all financial work is getting a good understanding of the base Panda-NumPy-Matplotlib stack. Pandas will help clean up the data, analyze time series, and combine different data that do not merge effectively, whereas Matplotlib/Seaborn/Plotly will allow one to create quality interactive data to present to the stakeholders.

- Focus on Automation: Experts ought to concentrate on automation of the repetitive, low-value tasks. This involves automating data mining of APIs, generating regular compliance reports, conducting daily portfolio reconciliations, and generating presentation-ready reports. The automation results in the liberation of time to engage in high-value/strategic analysis.

- Embrace Version Control: Finance teams are required to embrace standard best practices in software engineering, specifically the use of Git as a version control system to reduce the technical debt and collaboration challenges. This guarantees transparency, easy rollback of mistakes, and joint theorizing of models.

- Adopt a Hybrid Approach: In case of performance-sensitive modules (e.g., core execution logic), make use of the fact that Python can be interoperable with deeply performant compiled code, or adopt libraries that have been implemented to be fast. Python is mostly used in research, prototyping, data wrangling, and the high-level strategic outer shell of an application, whereas overall optimization of calculations is done using the inner core. This mixed method provides speed of development and effectiveness in execution.

Future Trends of Python in the Finance Industry

Python has fundamentally changed the standards of operations used within the field of finance, as it has made core financial processes much more efficient, accurate, and fast. With the ever-changing technologies, what will Python become in finance?

Emerging Trends in Python Applications

Python will continue to have a bright future in finance long beyond simple quantitative analysis and algorithmic trading, and turn into a critical focus on data ethics and sustainability issues. With the increasing use of more intricate AI/ML models, which financial institutions use, all of which depend on Python packages such as TensorFlow and Scikit-learn, comes an essential requirement of explainable and transparent systems (XAI).

The innovation of Python in the future will be based on the design of tools and frameworks that will guarantee fairness in algorithms, non-bias in lending and risk models, and strict privacy and accountability of data. This emphasis is necessary to ensure compliance with the regulations and trust in the public in the age of automated decision-making.

At the same time, ESG (Environmental, Social, and Governance) and sustainable finance investing will become one of the key growth zones. The most popular tool in this trend is Python, which is used to read, normalize, and process enormous volumes of both structured (e.g., carbon emissions data) and unstructured (e.g., corporate sustainability reports through NLP) ESG data.

The development of solutions using Python will facilitate the development of tailored ESG scores, the incorporation of sustainability metrics into the creation of a portfolio, and the measurement of performance against climate risk and financial risks, thus making Python a language essential to the ethical and responsible utilization of capital.

Call to Action

The changing nature of the finance profession requires professionals to continuously upgrade their analytical tool wealth. To the people in finance, whether they are analysts and risk managers or auditors and business leaders, the imperative is clear: explore and master Python further. Python literacy is no longer a niche skill used by quants but a fundamental skill for making decisions with data, allowing you to automate common functions and unlock the possibilities of advanced analytics.

In the case of organizations, the key to success in this digital shift, particularly in such a complicated sphere as AI governance and ESG data integration, cannot be achieved solely through internal training. We strongly recommend that financial institutions contemplate collaborating with Python specialists, including Orient Software, to achieve an easy and effective adoption. With expert consulting and development capabilities, you can enhance the development of robust, compliant, and scalable Python solutions faster and ensure that your organization remains the leader in innovation and that it has a competitive advantage in the fast-changing financial industry.