5 Tips for a Winning Fintech Software Development Strategy

Content Map

More chaptersFinancial technology, or fintech for short, refers to businesses that “offer financial services to consumers primarily through technology and cloud services, with less emphasis on physical premises. (McKinsey)

With the Internet and technology comes a new era of financial services. Most of us probably have one or two money or mobile banking apps on our phones right now and rarely ever step inside a bank. Such significant changes ask for leaders who can navigate the complexity of fintech and understand the nuances of successful software development are poised for success.

This article offers the ultimate tips for successful fintech software development and what mistakes to avoid. Whether you choose to use fintech software development companies or have experience developing software solutions, this guide is a must-read.

Key Takeaways:

- The top 5 tips for fintech software development include:

- Strategically leveraging legacy code to your advantage.

- Thoroughly grasping all the key laws and regulations. Your team should put an emphasis on this early on in the project.

- Utilize cutting-edge technology as the market is constantly evolving with higher demands and challenges.

- Implement a CI/CD pipeline to streamline your development and deployment processes to improve productivity and reduce time to market.

- Take a data-driven approach to stay goal-focused and make informed decisions that drive success.

Key Tips for Fintech Software Development

If you are trying to identify what a typical fintech institute looks like, there is no single answer. Fintechs may be banks, growth companies, start-ups, and even non-bank financial institutions. Examples of fintech include:

- Digital Payment Processors: These businesses offer online payments, money transfers, and mobile financial transactions. Examples: Paypal, Venmo, Stripe .

- Lending Platforms: These are platforms that offer small business loans, peer-to-peer lending, and other personal financial services. Examples: SoFI, Lending Club.

- Wealth Management and Robo-Advisors: Through apps, these companies offer automated financial planning and investment services. Examples: Betterment, Wealthfront.

- Cryptocurrency and Blockchain Services: Digital currency exchange along with digital wallets and blockchain solutions are among some of the services these businesses offer. Examples: Coinbase, Binance.

- Insurtech: Using technology like AI and ML, insurance companies aim to improve the traditional insurance industry. Examples: Lemonade, Next Insurance

With this knowledge in mind, no matter what your starting point is, knowing the best fintech software development tips takes you one step closer to success.

Tip #1: Leverage Legacy Code Strategically

The financial industry has long utilized technology in its operations. Legacy codes are the foundation upon which many traditional banks are built. However, many view them to be a hindrance to modern operational efficiency. According to 2018 research by Accenture, nearly four-fifths (79%) of operational leaders at North American banks feel that their bank’s survival will be challenged if they don’t update their technology to innovate faster and more efficiently.

Instead of completely evading or dismissing legacy codes, the best fintech software development companies find ways to leverage them to their advantage. They view the codes as an opportunity for transformation – after all, these codes have once served the business well, so handling them well provides companies with great advantages.

Key Strategies for Understanding Legacy Code

Understanding legacy codes reduces risks and maximizes the value of the existing investments. Here are several ways fintech software development services, or your in-house team, can go about it:

- Assess the Codebase: Set up the environment, run the code, and use tools like linters and dependency analyzers for a high-level overview.

- Leverage Documentation and Comments: Review available documentation and update it as necessary with detailed comments and changelogs.

- Use Code Analysis Tools: Tools like SonarQube and PMD help identify issues, dependencies, and code structure.

- Analyze Version Control History: Git commands (e.g., git blame and git log) help track changes and understand the development history.

- Refactor and Clean up: Carefully restructure the code while maintaining its behavior, focusing on small, tested changes.

- Testing and Validation: Write unit, integration, and end-to-end tests to ensure code reliability and prevent regressions.

In short, reframing legacy codes is essential for a smooth operation and strategic, incremental modernization.

Tip #2: Assure Thorough Knowledge of Domain-Specific Regulations and Security

Fintech used to be unregulated for quite some time, but that has changed. It is now a strictly regulated sector, be it in digital payment solutions, mobile banking solutions, or personalized financial services. Numerous reasons are behind this strict regulation, including:

- The protection of financial institutions, their clients, and the financial economy from financial crimes,

- The establishment of trust and credibility, and

- Fair competition.

Regulations Fintech Companies Must Comply with

Specific laws are applied depending on the country or area of your business. However, below are the basic regulations every fintech needs to oblige:

KYC (Know Your Customer)

For decades, companies have implemented Know Your Customer (KYC) processes to verify user identities, safeguard against fraud, and ensure adherence to anti-fraud regulations. These measures are critical for maintaining regulatory compliance and protecting businesses from financial crime.

GDPR (General Data Protection Regulation)

GDPR establishes rules for gathering and using customer’s personal data. As consumers’ awareness of the importance of data privacy continues to grow, the financial industry finds itself at the forefront of data security concerns. The safeguarding of sensitive financial information is crucial.

AMLD Regulations

The Anti-Money Laundering Directive (AMLD) is a set of EU regulations aimed at combating money laundering and terrorist financing by establishing consistent rules across all member states. Each EU country incorporates the AMLD into its legal framework, often aligning it with FATF (Financial Action Task Force) guidelines to prevent criminals from legitimizing illegally obtained funds.

PCI DSS (Payment Card Industry Data Security Standard)

This is a set of guidelines designed to protect payment card transactions and cardholder data from cybersecurity threats and fraud. While not a legal requirement, PCI DSS is often a contractual obligation for businesses that handle payment card information, ensuring they maintain a secure environment for customers.

Above are some of the most crucial regulations. Electronic Money Regulations (EMR), Consumer Protection Laws, Cyber security laws, etc. are among many other rules fintech businesses need to be aware of. Be sure to research the regulations and laws thoroughly right form the beginning of the project.

Security Measures for Fintech Software Solutions

In addition to complying with legal requirements, fintech solutions must implement fundamental security measures. If you partner with a fintech software development company, they will take care of it for you, but it’s best to have an idea of what these security measures are:

- Regular backup

- Data storage encryption

- Role-based access control

- Unit tests for access control

- Vulnerabilities monitoring in installed packages

- Encryption key management

- Single entry point guarantee

Tip #3: Utilize Cutting-Edge Technologies

Whether you partner with an outsourcing company or utilize the in-house team for custom fintech software development, properly investing in the tech stack can have a significant impact on the development process. Let’s take a look at the key technologies that shape financial technology in the digital world.

Artificial Intelligence (AI) & Machine Learning (ML)

Artificial Intelligence and Machine Learning bring multiple benefits to the fintech industry, including high efficiency, automation, and precision. The potential of AI and ML is endless.

- AI and ML can provide 24/7 support for customers and answer frequently asked questions via chatbots.

- Coupled with advanced data analytics systems, AI and ML can help spot fraud, assess loan default, and improve loan offerings.

- The technologies help with automatic compliance monitoring and feedback for any inaccuracies.

- Investors can use AI and ML to come up with personalized investment strategies.

- AI and ML can help track personal finances and even automate tradings.

Blockchain Technology & Decentralized Finance (DeFi)

Blockchain technology continues to disrupt traditional financial systems, and the emergence of Decentralized Finance (DeFi) has presented opportunities for a more secure, efficient, and transparent financial ecosystem.

- Security & Transparency: Provides an immutable ledger for transactions, reducing fraud and enhancing transparency.

- DeFi Platforms: Eliminates traditional intermediaries using smart contracts for services like exchanges, lending, and yield farming.

FinTech Cloud Adoption

The modern finance landscape is complex and demanding. Businesses are slowly transitioning to cloud computing platforms due to their immense capability and benefits.

- Scalability: Companies can adjust resources based on demand without physical infrastructure costs.

- Flexibility: Not only do cloud adoptions allow quick deployment, but they also allow speedy updates of financial applications.

- Cost-Effectiveness: Cloud platforms reduce infrastructure and even human resources costs.

- Enhanced Data Management: Supports big data technologies for better analytics and forecasting.

Regulatory Technology (RegTech)

Regulatory compliance is undergoing a digital transformation with the advent of RegTech, a rapidly evolving field that leverages cutting-edge technologies like blockchain, AI, and natural language processing to enhance compliance efficiency and effectiveness. While still in its early stages, RegTech is gaining traction as a disruptive force in the compliance landscape, with start-ups and established players alike seeking innovative ways to streamline and automate compliance processes.

Internet of Things (IoT) Integration

Fintechs are changing the ways they interact with the physical world with IoT integration. It has the potential to impact almost all aspects of the finance world, from digital payment to digital banking solutions. IoT integration with Fintech helps you:

- Improve risk management

- Develop new payment systems

- Streamline financial operations and reduce overall costs

Tip #4: Implement Continuous Integration and Delivery (CI/CD)

With the explosive growth of technology and rapid fintech evolution comes high expectations for new services and faster release cycles. This drives the need for continuous improvement and innovative solutions. The implementation of continuous integration and delivery (CI/CD) helps fintech businesses improve the quality of software and speed to market by improving product quality, facilitating integration, automating manual tasks, and reducing response times to issues.

Despite all these benefits, there is still an adoption gap. A 2020 poll by Gitlab revealed that out of 3,650 participants, just 38% said they used CI/CD in their DevOps processes. Hence, to leverage the benefits of CI/CD, including faster feature releases and enhanced flexibility, businesses need to keep the following best practices in mind.

- Ensure Team-wide Knowledge: Everyone involved in the CI/CD process should understand the potential risks and know their role in minimizing them. Proper education and communication are key to maintaining security and efficiency.

- Reduce Attack Surface: Identify weak points in the infrastructure and ensure your CI/CD strategy addresses them. This helps secure applications from vulnerabilities while maintaining high availability for customers.

- Practice Threat Modeling: Conduct early-stage threat modeling to identify, prioritize, and address potential security threats in the CI/CD pipeline. This proactive approach helps mitigate risks before they become major issues.

Tip #5: Adopt a Data-Driven Approach

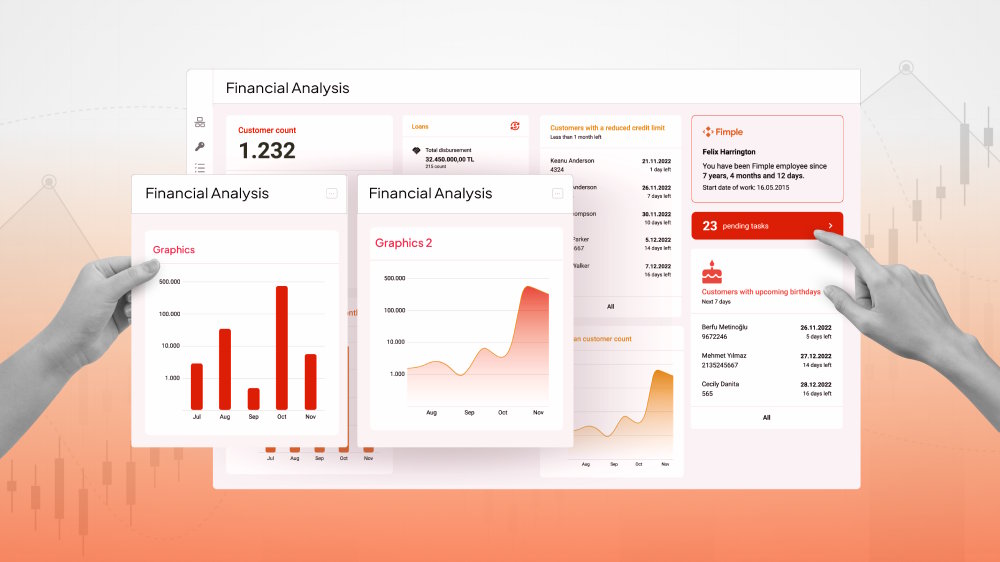

Financial software development should be clear and data-based. This can be done during the planning stage of the software development project. During this stage, key performance indicators (KPI), such as response metrics, defect rate, or delivery rate, will be set. Not only will these data keep the development process goal-focused and unambiguous, but they will also allow the fintech app to thrive. Fintech, after all, thrives on data.

AI, ML, Big data, and data analytics all play a role in facilitating a data-driven approach for fintech software. PayPal and Square are two examples of businesses that successfully utilized data analytics:

- Data Examination: Data analytics analyzes large and complex data sets to uncover patterns and insights.

- Informed Decision-Making: Leaders can make confident decisions with reports regarding customer behavior, market trends, and other data points.

- Risk Management: By identifying historical data patterns, businesses improve risk assessment when it comes to lending and pricing decisions.

What’s Next?

Armed with these insider tips, you are ready to embark on an impactful fintech software development journey! While the road ahead may require commitment and investment, rest assured that Orient Software is here to support your vision and alleviate concerns. With nearly two decades of experience in developing financial applications, our team brings expertise in navigating compliance and security and building exceptional user experiences. Reach out to us today, and let’s collaborate to bring your financial software development project to life!