Cybersecurity in Fintech: How to Protect Trust, Transactions, & Innovation

Digital payments are super convenient, but they’ve also made fintech a big target for cybercriminals who move just as fast as the tech does.

Content Map

More chaptersCashless payment has become an integral part of many daily lives. Millennials and Gen Z have chosen to ditch cash for cards, Apple Pay, and other forms of cashless payments. For example, many Asian countries prefer card payments over cash: in Korea, 77% of the payments are cashless, in China, this number is 67%, and in Vietnam, 56% have shifted towards digital payments.

It’s apparent that digital payment solutions have made significant advances. If we zoom out a bit, the widespread adoption of digital payments reflects the rapid growth of the fintech (short for financial technology) industry. However, what follows suit, and evolves just as quickly, is the growing security threats: fraud, data breaches, and other security vulnerabilities.

No company wants to deal with the nightmare of handling fraud or security breaches. Today’s article will discuss the importance of cybersecurity in fintech, why it is so important, and the steps one can take to prevent malicious attackers.

Key Takeaways:

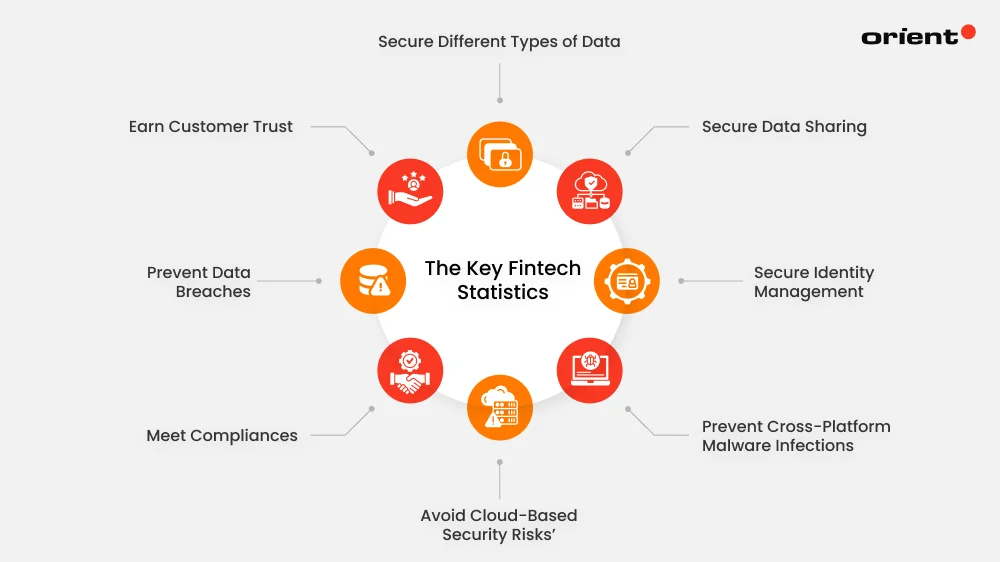

- Ensuring cybersecurity in fintech is crucial as it secures every aspect of data storing and transferring, while earning customers’ trust and meeting compliance requirements.

- While cybersecurity in traditional banking is heavily regulated, fintech’s security requirements are often looser, but that is quickly changing.

- Fintech companies are prime targets for malicious attackers due to the sensitive nature of the data they handle on a daily basis. That’s why weaknesses in API, authentication, authorization, or from external partners are all vulnerabilities that could lead to data breaches.

- To stay secure in today’s digital world, businesses need to protect themselves from the inside out: from training employees to spot threats to encrypting data at every stage. Another smart move is to tap into the latest cybersecurity tools and partner with a trusted outsourcing company, an efficient way to strengthen your defenses without stretching your team’s resources too thin.

The Growing Importance of Cybersecurity in Fintech

To fully understand the context of fintech’s growth over the years, here are some key statistics to put its growth into perspective, according to a report by McKinsey:

- The Fintech venture capital (VC) funding journey hit a massive peak in 2021 at $92.3 billion - a staggering 177% year-over-year increase, before receding significantly in 2022 with a 40% decline.

- Despite the market receding, the long-term outlook remains strong, with fintech revenues projected to grow three times faster than traditional banking by 2028, posting an anticipated annual growth rate of 15%.

Regarding fintech’s growth and revenue, the numbers are just as impressive:

- The global fintech landscape saw explosive growth, with the number of startups more than doubling from 12,000 in 2019 to over 26,000 by 2021/2022, accelerating the market toward a projected $1 trillion valuation by 2034. (BCG)

However, fintech companies are prime targets of cyber attacks as they manage a wealth of customers’ sensitive data daily. IBM’s Cost of a Data Breach Report 2024 highlights the expensive consequences of cybersecurity attacks:

- Data breach costs in the financial sector averaged $6.08 million in 2024, making it the most expensive industry for incidents and well above the $4.88 million global average. This makes the average cost of a data breach in the financial sector 24.6% higher than the global average.

- It takes an average of 168 days to identify and 51 days to contain a data breach.

It is apparent that cybersecurity attacks place a lot of burden on the fintech industry. Taking careful and thorough security measures is how companies safeguard their businesses and customers’ sensitive data.

Secure Different Types of Data

Similar to traditional banks, fintech companies handle a large volume of sensitive data each day, ranging from a customer’s personal information to their account balances, card numbers, transactional history, and more. As a result, this makes them a goldmine for malicious attackers, so fintech businesses need to constantly stay alert and updated on the latest cyber threats.

Secure Data Sharing

Fintech organizations need to have strong security systems to facilitate safe data sharing. Data sharing should not only be secure but also private. Without the ability to ensure these basic security requirements, it’s almost impossible to gain customers’ consent to share the data.

Secure Identity Management

Identity theft has been a serious problem in recent years. A recent report by The Future of Global Identity Verification found that 69% of organizations worldwide have faced more identity fraud attempts in the past two years. On average, businesses lose about $7 million a year to fraud-related costs like chargebacks, remediation, and brand damage. In the Asia-Pacific region, identity theft, fake account creation, and digital document forgery top the list of growing threats.

Robust cybersecurity protects customers’ identities and prevents malicious attackers from using sensitive information to conduct such fraud. Secure identity management also allows companies to provide customers with an omnichannel experience.

Prevent Cross-Platform Malware Infections

To allow for a smooth omnichannel experience, it’s only natural that fintech companies work and collaborate across different platforms. One loophole is all it takes for attackers to penetrate the system and steal data.

Avoid Cloud-Based Security Risks

Similar to other sectors, fintech businesses rely on the cloud for their mobile app development, payment gateways, e-wallets, speed, scalability, and accessibility. Cloud ecosystems often face problems involving insecure APIs or third-party risks, so companies need to review and ensure there are no vulnerabilities that attackers can use.

Meet Compliances

Even though the fintech industry isn’t as heavily regulated as the traditional bank sector, there are still standards and regulations it needs to follow. Depending on the country or region you operate in, there are specific security compliances that you need to follow. For example, fintech companies operating in the European Union need to follow the following key regulations:

- General Data Protection Regulation (GDPR)

- Payment Services Directive 2 (PSD2)

- Markets in Crypto-Assets Regulation (MiCA)

Prevent Data Breaches

The consequences of data breaches are dire, especially as the fintech industry deals with a massive amount of sensitive data.

- Financial burden: Data breaches are expensive. The financial sector has constantly ranked among the most expensive costs of data breaches in recent years.

- Data breaches force operational downtime, system shutdowns, and ultimately result in direct revenue loss.

- There are severe regulatory penalties for non-compliance. For example, the GDPR potential fine reaches up to 4% of annual global turnover.

- Most jurisdictions (e.g., US states and EU nations) legally require firms to immediately disclose the incident and notify all customers if their data was exposed, worsening public scrutiny.

Earn Customer Trust

Many customers trust digital financial platforms with their savings and investments. Ensuring cybersecurity is how you maintain customers’ trust and maintain their sense of security. A single data breach permanently damages a customer’s trust, increases the rate at which they leave, and makes it much harder for you to acquire new customers. This is not to mention the significant reputation harm sustained, costing future partnerships and opportunities.

How Does Cybersecurity in Banks Differ from Cybersecurity in Fintech?

Both traditional banks and fintech are often prime targets of cybersecurity attacks, but their security nature in the digital world is quite different.

Regulatory & Compliance

- Traditional banks are heavily regulated with strict compliance requirements. Security is part of those strict regulations, compliance with non-negotiable laws built around it.

- Fintech, on the other hand, involves less strict regulations as it often involves small or fast-growing startups. However, this is quickly changing, too, with the emergence of laws like MiCA and DORA. Still, the section regulations and compliance mostly rely on market necessity and customer trust.

Technology

- Traditional banking relies on legacy systems that are heavily secured. These organizations often test and upgrade their systems to avoid data breaches and penalties.

- Fintech businesses are built on modern technology like cloud-native or API-based architecture for speed and scalability. However, this can also mean that their security systems are not as robust, with higher vulnerability potential.

It’s worth noting that some fintech businesses evolve into licensed banks. When fintechs obtain banking licenses, they face stricter oversight, mandatory security audits, and tougher data protection standards, requiring a major shift in their security posture. Other fintech companies may act as an “overlay” to banks. Fintechs often build digital solutions that simplify or enhance banking services such as payments, loans, or investments. This collaboration speeds up innovation but also introduces integration risks if APIs or third-party tools aren’t properly secured.

Most Common Vulnerabilities in Cybersecurity

The first step to not turning oneself into a goldmine for malicious attackers is understanding the most common threats in cybersecurity.

API Security Weaknesses

API (Application Programming Interfaces) are the backbone of modern fintech systems. They are the tools that allow fluid real-time data sharing and integration across different platforms. However, this very interconnectedness can cause a serious security vulnerability without sufficient protection. Businesses need to watch out for some of the most common API attacks:

- Authentication bypass: Attackers can pose as legitimate users by exploiting flaws in the authentication layer (like token theft or session hijacking) to access sensitive data or even carry out unauthorized transactions.

- Broken Object Level Authorization (BOLA): This happens when an API doesn’t properly verify if a user is authorized to access specific data. Without deeper checks, attackers can retrieve or manipulate data they shouldn’t have access to.

- Business logic exploitation: Instead of finding ways to break the system, attackers misuse API functions to take advantage of vulnerabilities to bypass safeguards and manipulate financial transactions.

Authentication and Authorization Flaws

Authentication remains one of the weakest links in fintech security. Despite the rapid growth of technology, many organizations still rely on older or fragmented systems, leaving them exposed to malicious attackers.

- Hackers no longer need advanced skills. With Phishing-as-a-Service (PhaaS) platforms, anyone can rent ready-made toolkits to run mass authentication attacks.

- Many fintech and banking organizations rely on multiple identity providers (IdPs), especially those that have expanded through mergers or acquisitions. Each system may have different authentication rules and security levels, creating inconsistent user experiences and encouraging insecure habits (like password reuse or storing credentials on sticky notes).

Third-Party Integration Risks

It is common and necessary to partner with third-party vendors, suppliers, or contractors. However, interacting with external partners opens doors to cyber threats.

- If a vendor is facing a data breach, your firm’s sensitive data can also be exposed or stolen.

- Integrating systems from third-party partners can introduce security weaknesses that allow attackers to exploit, attack, and infiltrate your network and launch ransomware attacks.

- Should your partner fail to meet legal standards, your company might suffer fines or lawsuits. Even if the data is handled by another party, you are still responsible for the regulatory compliance.

Data Storage and Transmission Vulnerabilities

Fintech firms typically handle a massive amount of data each day. Each stage, from storage to transmission to interaction, can create potential cybersecurity threats. Most of these threats can be contained, as they often stem from developers’ oversights or insecure design choices, like:

- Storing passwords in plain text or using weak hashing algorithms like MD5 or SHA-1,

- Using outdated HTTP instead of HTTPS, which exposes data during transmission,

- Integrating insecure APIs without authentication or proper encryption, etc.

These vulnerabilities can expose sensitive financial and personal data. Transmitting data over unsecured networks (without TLS/SSL) also makes it easy for attackers to intercept information through man-in-the-middle attacks.

Risk of Data Breaches

In the fintech world, API weakness, authentication failure, loopholes in third-party integrations, data storage, and transmission can all ultimately lead to a larger consequence: data breach.

With sensitive information constantly moving between systems, a single breach can result in financial loss, regulatory penalties, and reputational damage.

Determined attackers will launch a variety of attacks to obtain the data they want, whether it is phishing attacks, taking advantage of API weaknesses or unsecured storage, or sneaking in malware. Data breaches don’t happen from external factors alone; they can also happen due to an insider’s negligence: weak or stolen credentials (easy-to-guess passwords or stolen login details), unpatched software and application vulnerabilities, or human errors.

Proven Strategies to Strengthen Cybersecurity in Fintech

Raise Awareness Among Team Members

Untrained employees are a favorite target of hackers. This is why companies need to foster a culture of cybersecurity awareness among team members.

Training cybersecurity isn’t a one-and-done task; it should be an ongoing initiative to eliminate human error and insider threats. Comprehensive training ensures employees are aware of the latest threats, and simulated exercises allow them to become more adept at identifying threats and handling the situation safely.

Secure-by-Design and Shift-Left Security

A secure-by-design approach means integrating security into every stage of a fintech product’s lifecycle instead of treating it as an afterthought. It starts with defining security requirements alongside product goals and using threat modelling to identify and address potential risks early.

Security testing should be built into CI/CD pipelines, ensuring vulnerabilities are caught automatically during development. This proactive “shift-left” strategy helps teams fix issues before they become costly.

Finally, fintech teams need ongoing developer training in secure coding, authentication, and input validation to ensure consistent protection across all systems. By adopting secure-by-design principles, fintech firms can build stronger, more resilient products that meet strict cybersecurity standards and safeguard customer data from the ground up.

Multi-Factor Authentication Implementation

Multi-factor authentication, or MFA, requires the user to verify their identity using two or more authentication factors. This often involves credentials like a password along with their biometrics or OTP for a smartphone.

Companies should implement MFA for all employees across all platforms. MFA is by far the most effective method and defense against password-related attacks. As a matter of fact, Microsoft suggested MFA can help stop 99,9% of account compromises.

Regular Security Assessments and Penetration Testing

Regular reviews and vulnerability scans aren’t simply good practices; they are a fundamental requirement for trust and survival.

These tests safeguard sensitive information and are also part of mandated regulatory compliance with multiple guidelines and standards like GDPR and PCI DSS. Performing regular security scans ensures that fintech firms keep up with the risk of agile development and potential data leaks from API and clouds. The frequency of these tests depends on numerous factors, but these tests should be carried out annually at a minimum.

Comprehensive Encryption Strategies

Data should be encrypted at every stage, both at rest and in transit. Use strong encryption standards like AES-256 for stored data and TLS 1.3 for data in motion to keep sensitive information fully protected. Even if the data is intercepted or stolen, it’ll remain unreadable without the decryption key.

Similar to regularly changing passwords, fintech companies should regularly rotate their encryption keys to minimize the risk of unauthorized access. These keys must be stored securely and managed under strict access controls.

Incident Response Planning

In the unfortunate case of a security breach happening, it’s crucial to have an incident response plan in place. It’s a written roadmap that specifies how the business will be prepared for, identify, contain, eliminate, and recover from a significant security breach, cyberattack, or system interruption.

After an incident happens, it’s a good practice for companies to hold a meeting and discuss the “lessons learned” – what worked, what could have been done better, etc. The incident response plan should then be updated accordingly.

Comprehensive API Security

Comprehensive API security starts with strong authentication. To verify the right users who access the system, fintech firms typically use OAuth 2.0 and JWT tokens, both standard methods.

After the authentication step comes authorization, which controls what each user can do once they are granted access, this can be done based on a user’s job role or based on conditions like risk level or location. Both these methods try to ensure access is limited and context-aware.

To prevent hackers from injecting malicious data into the system or exposing sensitive data, another vital layer is input validation and output encoding. Lastly, continuous monitoring and penetration testing are how companies detect suspicious activities in real-time.

AI-driven Threat Detection

Generative AI is revolutionizing cybersecurity in fintech, shifting it from reactive defense to proactive, self-learning protection. It predicts, detects, and even simulates attacks to seal security gaps before they’re exploited. With 95.7% detection accuracy and lightning-fast response times of just 12 milliseconds, AI outpaces traditional systems by far.

Beyond speed, it enhances fraud prevention through biometric analysis, deepfake detection, and blockchain monitoring. It also helps fintechs stay compliant with strict standards like PCI-DSS and GDPR by flagging risks and auto-generating audit reports.

Collaborate with a Credible IT Partner

To improve their cybersecurity posture, fintechs can partner with a trusted IT provider. A credible and reliable partner brings technical expertise and hands-on experience to handle the security of complex financial systems, stay ahead of threats, and all while ensuring compliance with regulations. Orient Software, for example, provides solutions to ensure secure software development and API protection with continuous monitoring. Working with a credible partner is how you can focus on growth and innovation.

Wrapping Up

Staying secure isn’t just a requirement; it’s the foundation of every fintech company’s success. Strong cybersecurity safeguards your reputation, protects your customers’ trust, and ensures your business can grow with confidence. While building a solid security strategy takes time and investment, it’s one of the smartest moves a fintech company can make for long-term stability and innovation.

One way to take all the burden of planning and choosing tactics is to have a partner do it for you. Orient Software is more than happy to assist you. Contact us today!